Published On:

28 September, 2024

Reading Time:

20 minutes

Category:

Accounting & Business

Written By:

Sareen

SaaS businesses have budgeting and accounting requirements that are difficult for general accounting software to meet. To support your rapid growth and keep your balance sheets in check, you need the right accounting software suited to and aligned with your business needs.

Check out our comprehensive guide to the top 10 best accounting software for SaaS businesses in 2024.

List of 10 Best Accounting Software for SaaS

- FreshBooks

- Sage Intacct

- NetSuite

- QuickBooks Online

- Xero

- Maxio

- GoCardless

- Zuora

- Recurly

- Zoho Books

1- FreshBooks

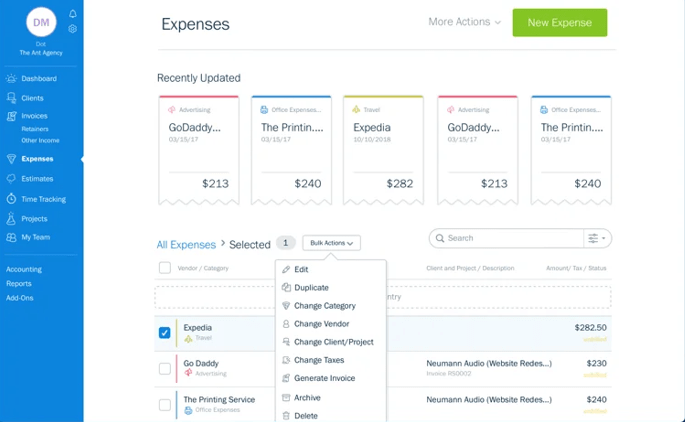

FreshBooks offers SaaS businesses an intuitive, user-friendly accounting solution that simplifies invoicing, expense tracking, and time management.

Designed for non-accountant users, its dashboard and automated processes allow SaaS brands to focus more on their core business activities rather than getting stuck trying to understand complex financial management tasks.

FreshBooks’ emphasis on client relationships and project management tools makes it a valuable asset for service-based SaaS models.

Features of FreshBooks

FreshBooks offers a wide range of features that can be useful for you. Here’s a list of features that we think can help your business to grow:

- Customizable invoices

- Payment Reminders

- Recurring Invoices

- Multi-currency billing

- Automatic Tax Calculation

- Expenses and Receipts Tracking

- Estimates and Proposals

- Time Tracking

- Projects and Collaboration

- Accept Payments

- Recurring Payments and Auto-Bills

- Financial Reporting

- Client Management

- Relationship Feed

- And more

Top 3 Features of FreshBooks

Among these features, the key elements that you can utilize for your SaaS company are:

1- Customizable Invoices

FreshBooks offers multiple capabilities in its invoicing features that benefit SaaS companies and are focused on professional and customizable invoicing. You can easily automate everything, from sending payment reminders to auto-billing recurring or subscription-based clients.

2- Time Tracking

FreshBooks time tracking features open doors to easier billing and team collaboration. Its time-tracking feature can be used anywhere from your phone or as a Chrome extension and automatically creates bills for tracked hours. Its multiple integrations with tools like Trello help understand how everyone spends their time and know what work has been completed.

3- Financial Reporting

You can analyze your business’s performance through FreshBooks’ feature of Financial Reporting and dashboard access. By understanding expenses and profits through visual analysis and reports, you can make informed business decisions to help your business grow.

Pros of FreshBooks

- Exceptionally user-friendly and easy for non-accountants to navigate.

- Mobile app is available for iOS and Android to manage finances on the go.

- Excellent customer service with multiple support channels.

- Regularly updated with new features and improvements.

- Automation of time-consuming tasks.

Cons of FreshBooks

- Lacks some advanced accounting features required for larger businesses.

- Limited inventory management capabilities.

- Reports might lack depth for complex analysis.

Pricing

Following are FreshBooks’ various pricing plans:

- Lite: Targets smaller client bases, offered at $5.70 USD/month.

- Plus: Designed for growing businesses, offered at $9.90 USD/month.

- Premium: Caters to larger businesses with advanced needs, offered at $18.00 USD/month.

- Select A customizable option for businesses with unique requirements.

Customer Support Options

FreshBooks offers various customer support options to assist its users. Here are the key support channels available:

- Phone support

- Help Center

- Knowledge base

- FAQs

- Video tutorials

- Forums

Average Rating

Based on the reviews given by the users, the average rating of FreshBooks is 4.5 out of 5.

Testimonials

Final Verdict

FreshBooks is an easy-to-understand software with predefined functionalities. While it may be a little restrictive, its predefined functionalities in its packages also let you know what you’ll be getting even before investing in it, which can help you plan your business goals accordingly.

2- Sage Intacct

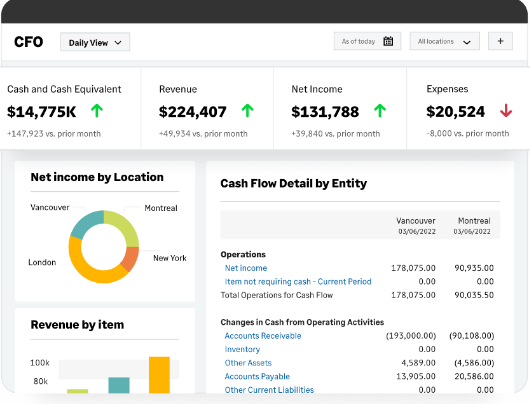

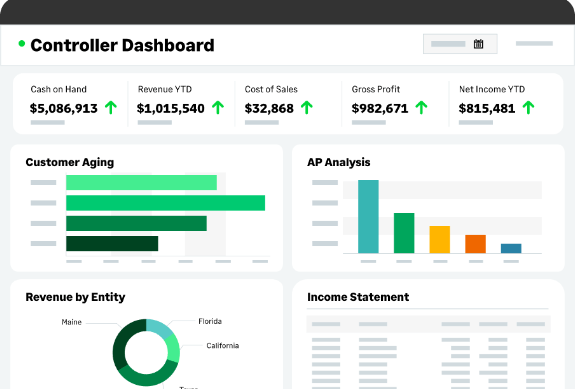

Sage Intacct offers financial management and accounting solutions that resonate with the needs of SaaS companies looking for scalability. It has a cloud-based system that provides real-time financial and operational insights to users, making it easier for businesses to manage complicated financial transactions and automated billing procedures.

Sage Intacct’s ability to handle multi-dimensional financial data allows SaaS companies to get a detailed analysis of their finances, aiding in better decision-making and financial planning.

Features of Sage Intacct

Here’s a list of features provided by Sage Intacct:

- Core financials

- Accounting Platform

- Planning

- Payroll and HR

- Global Capabilities

- Multi-Entity Global Consolidations

- Time and Expense Management

- SaaS Intelligence

- Interactive Visual Explorer

- Contract and Subscription Billing

- Revenue Recognition

- Project Cost and Billing

Top 3 Features of Sage Intacct

Following are the top 3 features of Sage Intacct:

1- Core Financials

The core financials of Sage Intacct offer extensive cloud-based accounting and financial management capabilities that are perfect for expanding businesses. With a strong emphasis on flexibility, Sage Intacct allows users to create customized financial reports, support multi-entity operations, and manage finances across different currencies and locations, ensuring compliance and informed decision-making.

2- SaaS Intelligence

SaaS intelligence provides your SaaS brand with real-time metrics dashboards that can be used to prove your success to investors and help you make business decisions. It enables you to organize metrics according to their priority and relevance and simplify those metrics for the finance teams.

3- Subscription Billing and Revenue Recognition

The platform simplifies financial operations by automating complex revenue and cost management procedures for a metric-based revenue view. Reduced manual billing lowers costs and improves billing accuracy. Subscription renewals are guaranteed, with 300 SaaS billing scenarios following standard compliance.

Pros of Sage Intacct

- Customizable accounting reports and dashboards

- Offers complex financial management capabilities

- Reporting with multi-dimensional analytics and advanced metrics

- The cloud-based system allows real-time financial visibility and collaboration

- Strong compliance management

Cons of Sage Intacct

- Very complex and might take a long time to implement

- Too costly for start-ups and small businesses

- Users might need training to use all features

- Might require consultation for customization

Pricing

- Annual subscription starts at $10,320.

- Includes 1 business user license, 1 business entity, and Core Financial Management.

- Average annual costs: $15,000 to $35,000.

Customer Support Options

Below are given customer support options by Stage Intacct:

- Online support center

- Live chat

- Email support

- Phone support

- Community forums

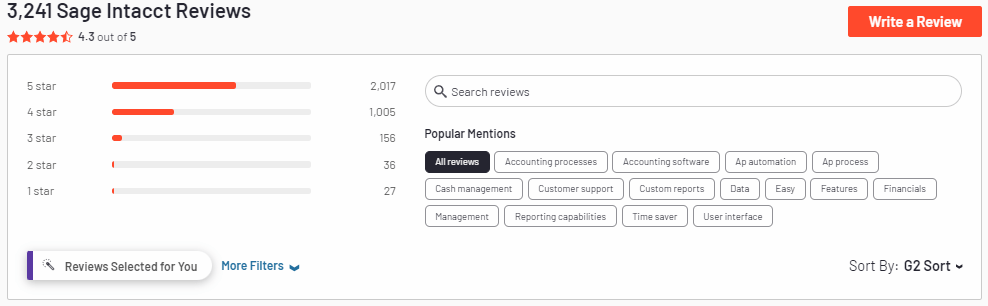

Average Rating

The average rating of Sage Intacct among popular directories, like G2 and GetApp, is 4.3 out of 5.

Testimonials

Final Verdict

Sage Intacct is a very flexible tool with many features and modules. While it may be a little costly for small businesses, it can easily be integrated into your business using different modules to fit your business needs, and you’ll only be billed according to your requirements.

3- NetSuite

NetSuite provides a large set of cloud-based financial management solutions designed for the unique needs of mid-size and large businesses needing SaaS solutions. It offers an integrated ERP, financials, CRM, and e-commerce system, facilitating a unified view of business operations.

Finance, accounting, inventory management, and forecasting are some of the features that are included in NetSuite’s module.

SaaS businesses can benefit from NetSuite’s scalability, which supports growth from startup to enterprise without requiring multiple software replacements over time. Its global financial capabilities make it an ideal fit for SaaS companies operating on an international scale.

Features of NetSuite

Here’s a list of features provided in the NetSuite cloud accounting software:

- General Ledger

- Cash Management

- Accounts Receivable

- Accounts Payable

- Account Reconciliation

- Tax Management

- Close Management

- Fixed Asset Management

- Payment Management

Top 3 Features of NetSuite

Among its numerous features, the best features that a user can benefit from by using NetSuite are as follows:

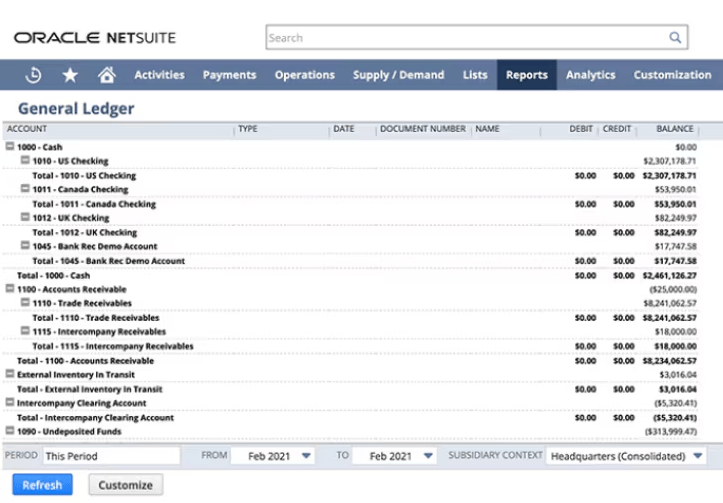

1- General Ledger

With NetSuite’s general ledger, accounting experts can customize the account types, transactions, and reporting segments to fit the specific needs. It also gives them flexibility and visibility, better reporting functionalities, and improved audit trails.

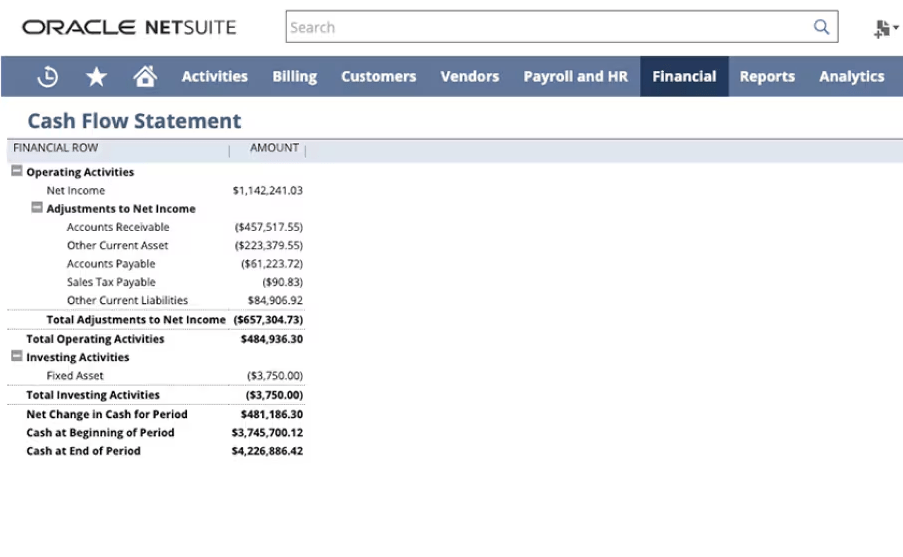

2- Cash Management

NetSuite provides a complete view of cash flow in its cash management feature. It helps finance teams make informed decisions using the right reporting tools, optimize cash flows, and monitor bank accounts.

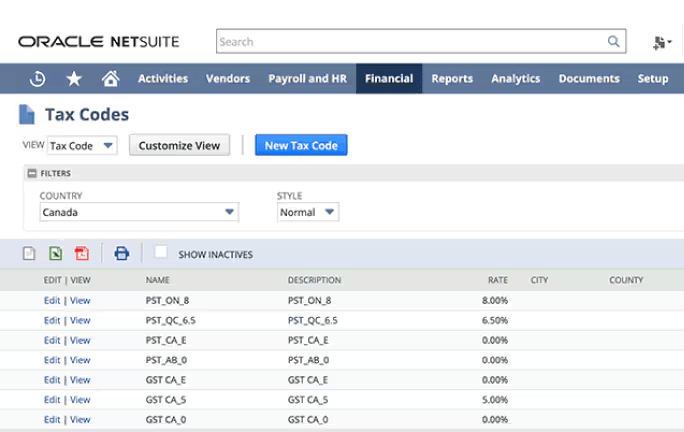

3- Tax Management

NetSuite helps you easily handle both local and international taxes using a single platform, creating detailed reports and analyzing transactions in real-time. It supports numerous tax schedules for consumption tax, general sales tax, GST, and VAT, as well as handling local taxes across subsidiaries.

Pros of NetSuite

- A unified business suite.

- Real-time business intelligence for detailed insights.

- Scalable to support both mid-sized businesses and large enterprises.

- Strong inventory management features.

Cons of NetSuite

- The initial cost and total cost of ownership can be high.

- Customization requires a technical understanding or external consultants.

- Some users find the interface less intuitive and somewhat dated.

Pricing

For NetSuite’s pricing plans, you need to talk with an Oracle sales professional in order to get an exact pricing estimate. NetSuite software price typically begins at around $20k annually.

- Monthly subscriptions start at $999, plus $120 per user.

- For 200 employees: $31,500 – $67,400.

- For 1000+ employees: $142,200 – $210,400.

- Additional advanced modules are available a la carte.

Customer Support Options

Following are the customer support options available at NetSuite:

- Phone

- Email Support

- Online Knowledge Base

- User Communities

- Training Resources

Average Customer Rating

The average rating of NetSuite across different Software directories, like GetApp and G2, is 4.0 out of 5.

Testimonials

Final Verdict

NetSuite stands out as an all-inclusive, cloud-based ERP solution designed to scale with businesses of all sizes, from growing startups to established enterprises. While its functionality and scalability make it an investment, NetSuite’s ability to customize and integrate with a wide array of systems ensures that businesses only pay for the features they need, making it a valuable tool for growth.

4- QuickBooks Online

QuickBooks Online is one of the best accounting software for SaaS and a cloud-based accounting program that easily interacts with external applications to improve its capabilities. Small business owners, new companies, and early-stage businesses with up to 25 users commonly utilize QuickBooks Online.

It offers a range of accounting resources, such as recurring billing, budgeting, time tracking, convenient client payment options, and reliable domestic payment functionality.

Features of QuickBooks Online

QuickBooks Online has many features under its services, making it an excellent choice for your SaaS business. Their features are as follows:

- Invoices

- Expenses

- Bank Feeds

- Tax

- Inventory

- Capture and organize receipts

- Mobile App

- Insights and Reports

- Multi-currency support

- Security

Top 3 Features of QuickBooks Online

QuickBooks has many features, but the best features that are offered by QuickBooks are as follows:

1- Invoices

QuickBooks simplifies the invoicing process, allowing users to create, customize, and send invoices directly to clients, helping speed up payments. Users can create professional invoices swiftly, personalize them as needed, and efficiently manage client billing, enhancing cash flow for businesses.

2- Expenses

It automates the tracking of business expenses, categorizing them for easy management and reporting, which aids in financial planning. This feature enables businesses to maintain accurate records, analyze spending patterns, and make informed decisions to optimize budget allocation and control costs effectively.

3- Bank Feeds

QuickBooks automates the tracking of business expenses, categorizing them for easy management and reporting, which aids in financial planning. By automating tedious manual tasks, QuickBooks enhances efficiency and transparency in financial management, empowering businesses to stay on top of their finances with ease.

Pros of QuickBooks Online

- An extensive network of accountants and professionals familiar with the platform.

- Regular feature updates and improvements.

- A vast array of integrations and apps are available in the QuickBooks ecosystem.

- Easy to set up and start using without extensive training.

Cons of QuickBooks Online

- Reporting and customization may not meet the needs of larger or more complex SaaS companies.

- Users report occasional syncing issues with bank accounts and third-party apps.

- Some advanced accounting features are only available in the more expensive plans.

Pricing

QuickBooks offers four different pricing plans: Simple Start, Essentials, Plus, and Advanced package, which you can also try for free for a 30-day trial period.

- Simple Start package costs $15 per month.

- Essentials package costs $30 per month.

- Plus package costs $45 per month.

- Advanced package costs $100 per month.

Customer Support Options

QuickBooks Online offers several customer support options, including:

- 24/7 Live Chat Support

- Phone Support During Business Hours

- Online Help Center

- Community Forum For User Discussions

Average Rating

The average rating given by customers of QuickBooks Online is 4.0 out of 5, gathered from Software Directories like G2 and GetApp.

Testimonials

Final Verdict

QuickBooks Online is a great software for startups and online businesses to opt for. Its easy-to-use features and insights make it a great first step toward making informed financial decisions and helping your SaaS startup grow.

5- Xero

Xero is a cloud-based accounting software suited for small to medium-sized businesses, making it a perfect fit for SaaS companies looking for financial management solutions.

With features like real-time financial reporting, multi-currency support, and smooth integration with over 800 apps, Xero provides SaaS businesses with the tools they need to manage their finances efficiently.

Its user-friendly interface and amazing security measures ensure that managing your business’s financial health is easy and secure.

Features of Xero

There are plenty of features that make Xero an excellent choice as accounting software for SaaS companies. All of these features are listed below.

- Pay Bills

- Claim Expenses

- Bank Connections

- Accept Payments

- Track Projects

- Pay runs

- Bank reconciliation

- Manage Xero contacts

- Capture data

- Files

- Reporting

- Inventory

- Online invoicing

- Multi-currency accounting

- Purchase orders

- Quotes

- Sales tax

- Analytics

- Accounting dashboard

- Manage Fixed Assets

- Integrate Apps

- Xero Accounting Apps

Top 3 Features of Xero

The top 3 features that set Xero apart from other accounting software as a SaaS company accounting software choice are as follows;

1- Bank Connection

Xero helps you automate financial transactions by linking directly to bank accounts, making it possible to have real-time financial data accuracy. This feature makes the reconciliation process easy, providing businesses with up-to-date insights into their cash flow and financial health.

2- Online Invoicing

Online invoicing facilitates quick billing and collection of payments from customers, improving the company’s cash flow. This feature offers convenience to both businesses and clients by providing an efficient platform for managing invoicing transactions.

3- Multi-Currency Accounting

Xero supports transactions in multiple currencies, which is necessary for SaaS businesses to operate globally. This capability ensures accurate recording and reporting of financial data across international operations, facilitating smooth cross-border transactions.

Pros of Xero

- Focused on automation for bank feeds, reconciliation, and repetitive tasks.

- Attractive and clean user interface.

- Offers a broad set of features for a fixed monthly fee.

- Strong focus on security with two-factor authentication.

Cons of Xero

- Some accounting professionals desire more in-depth features.

- Limited direct support options.

Pricing

Xero offers its services in three different pricing plans: Early, Growing, and Established.

- Early package: usually costs $15 per month, but only $6/month.

- Growing package: usually costs $42 per month, but only $16.08/month.

- Established package: usually costs $78 per month but only $31.20/month.

Customer Support Options

Below given are the available customer support options at Xero:

- Xero provides free 24/7 online customer support for subscribers.

- Support is mainly through Xero Central, featuring articles and support case options.

- If needed, contact Xero Support directly from the platform for further help.

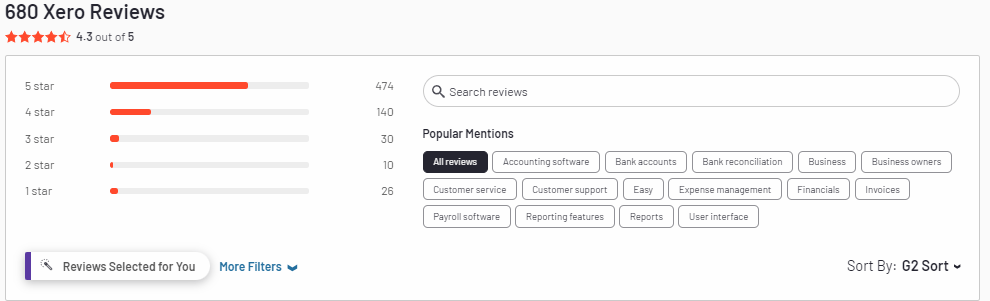

Average Rating

The average rating of Xero by its customers is 4.3 out of 5, gathered from Software Directories like G2 and GetApp.

Testimonials

Final Verdict

Xero is an excellent choice for SaaS businesses looking to grow. Its features allow you enough financial capabilities to keep growing steadily and upgrade its package when you need to upscale. Their packages are customized to suit the needs of all early-stage, middle-stage, and established businesses.

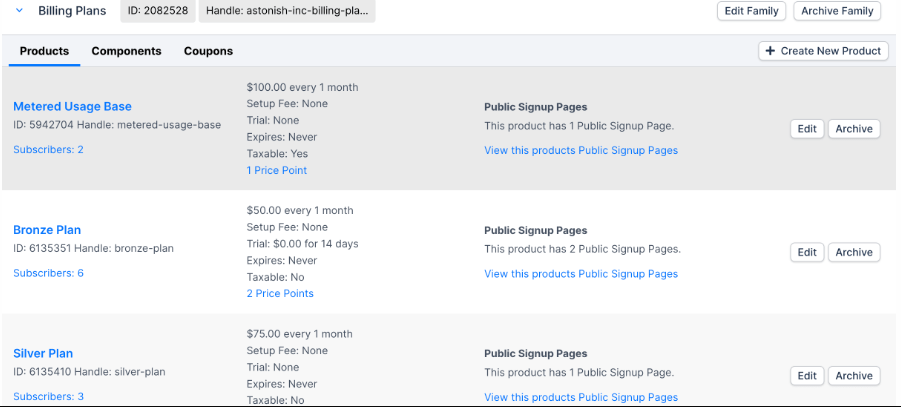

6- Maxio

Maxio is an all-inclusive financial operation and billing solution for B2B SaaS businesses. Its features are aligned to tackle the unique challenges faced by SaaS companies, like advanced subscription billing and management, revenue recognition compliant with accounting standards, and critical SaaS metrics for insightful analytics.

Features of Maxio

Here’s a detailed list of all the features offered by Maxio that you can use as a SaaS business:

- Maximo Platform

- Advanced Billing

- A/R Management

- Advanced Revenue Management

- Milestone-Based Projects

- Expense Amortization

- Subscription Billing

- SaaS Metrics

- Subscription Management

- Revenue Recognition

Top 3 Features of Maxio

Among all the features offered by Maxio, here are the top 3 features that are the most important to consider when deciding to choose Maxio as accounting software for SaaS:

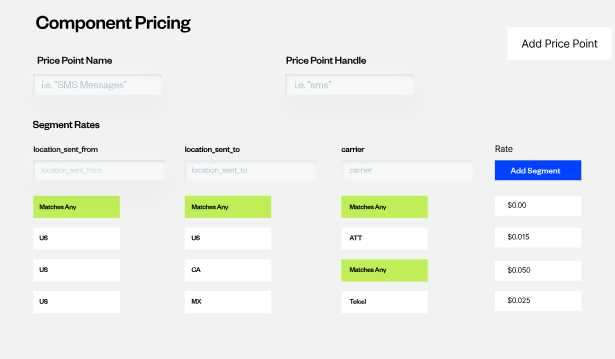

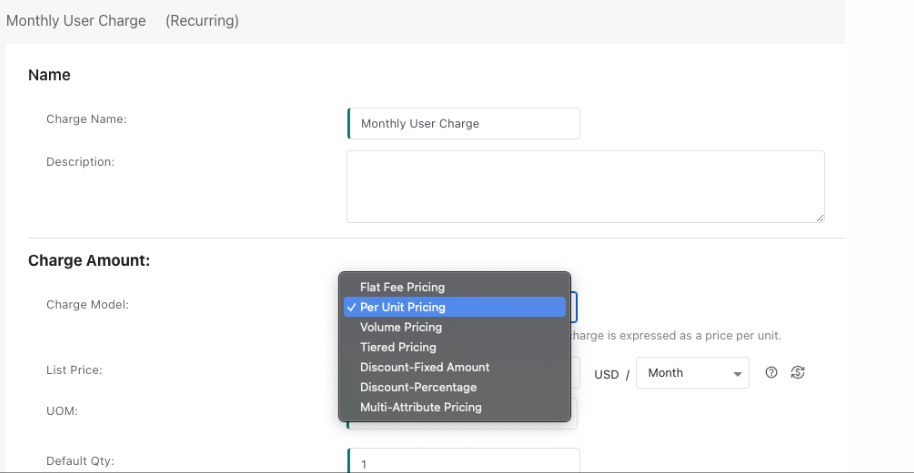

1- Subscription Billing

Maxio’s subscription billing feature is made for B2B SaaS, offering flexibility in product catalog, variable pricing, and multi-currency support. It accommodates custom pricing strategies for sales-negotiated contracts alongside self-service signups, giving room to scalability through usage-based pricing models. This makes it an adaptable solution for growing SaaS companies looking to organize their billing operations.

2- Subscription Management

Maxio’s subscription management software offers a “no code” solution for complex pricing strategies in B2B SaaS companies. It allows for customizing subscription plans without requiring developer input, supporting a flexible product catalog that enables SaaS companies to adjust their pricing and plans easily.

3- Revenue Recognition

Maxio’s revenue recognition for SaaS provides an automated solution to manage revenue recognition, maintaining compliance with financial standards like ASC 606/IFRS 15. It makes the revenue accounting process easier, reducing manual efforts and enhancing accuracy in financial reporting.

Pros of Maxio

- Designed to meet the specific needs of SaaS businesses.

- Ability to track key SaaS metrics like MRR and ARR.

- Offers billing and subscription to reduce dependency on additional software.

Cons of Maxio

- Limited community support compared to established competitors.

- Some features are still in development, causing potential functionality gaps.

- User interface may lack the polish of more mature software.

Pricing

Below is given the pricing plan of Maxio:

- Pricing depends on your business’s billing volume over the past 12 months.

- Scales with your needs and usage.

- Add or remove modules as needed.

- Base price: $5000 annually for up to $500K in annual billings.

Customer Support Options

Here are some customer support options available at Maxio:

- Help desk

- Knowledge base

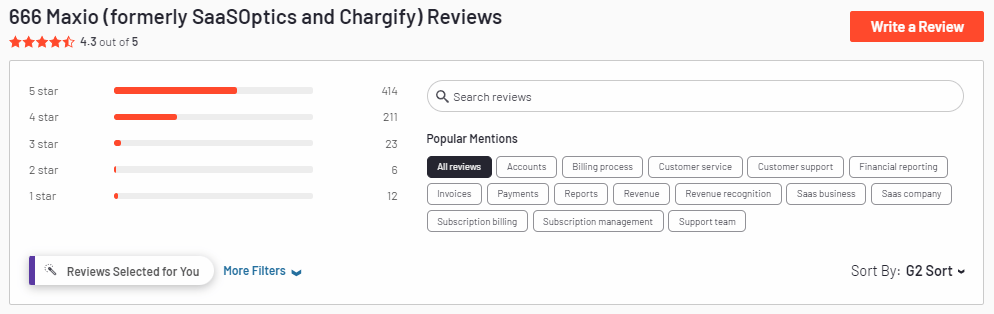

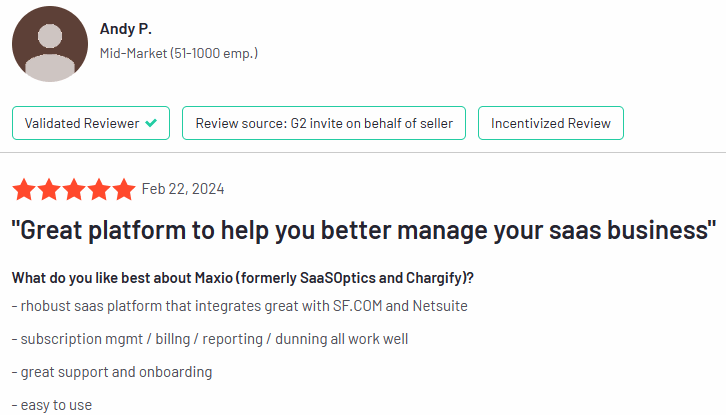

Average Customer Ratings

The average rating given to Maxio by users on Software directories, like G2 and GetApp, is 4.3 out of 5.

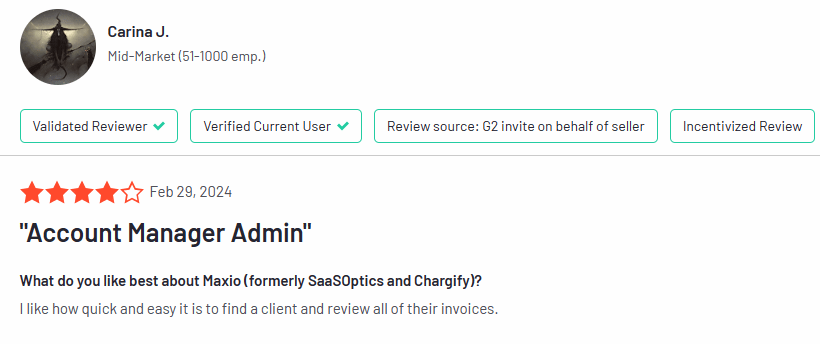

Testimonials

Final Verdict

Maxio is a good platform for SaaS companies aiming for growth. Its billing based on past performance and modular design allows you to pay only for what you need, making it perfect for managing finances smartly as you scale. Although a bit new in the market and would require improvements, it is nonetheless a great choice for accounting software to be used in a SaaS company.

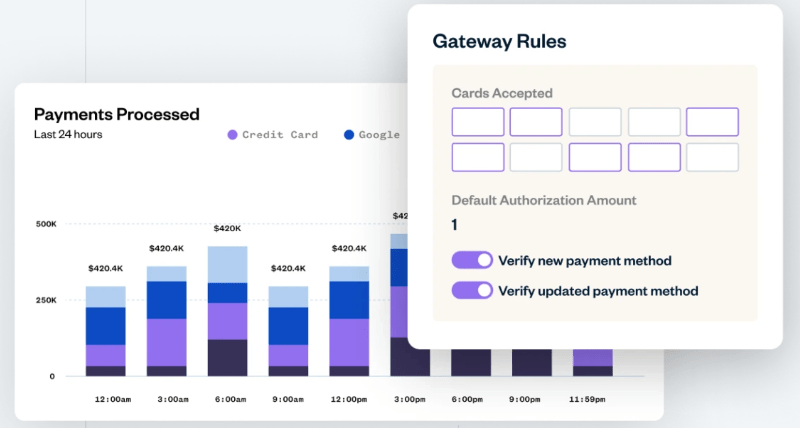

7- GoCardless

GoCardless is a payment platform designed to make the payment process for SaaS and subscription-based businesses easier. It stands out by offering an easy way to collect recurring payments across various currencies and countries, making it highly suitable for global SaaS operations.

Payments are automated due to the ACH network, making clients worry less about delayed payments.

Features of GoCardless

These are the list of features that make GoCardless an obvious choice for a SaaS business to have:

- Recurring payments

- International payments

- GoCardless Success+

- GoCardless Protect+

- Verified Mandates

Top 3 Features of GoCardless

Among its features there are three features that make GoCardless a must-have for SaaS businesses:

1- Recurring payments

GoCardless’s recurring payments feature is specifically stylized to handle subscription and membership payments. You can create your own flexible subscription plans to suit your business needs or set payment details once for invoices and collect one-off or recurring payments whenever they are due.

2- International Payments

GoCardless enables SaaS businesses to effortlessly manage and receive payments across different countries, supporting a global customer base. This feature simplifies handling multi-currency transactions using Wise, allowing businesses to expand their services worldwide without the complexity typically associated with international payments.

3- GoCardless Success+

Success+ helps manage payment failures through payment intelligence. It recovers, on average, 70% of failed payments. Upon failure, it retires payment automatically according to the number of times you’ve set in the API in the timeframe that works for you. It helps keep your customer experience smooth and hassle-free.

Pros of GoCardless

- Makes the collection of recurring payments easier, reducing administrative workload.

- Transparent pricing model with no hidden fees.

- Offers good integration capabilities with major accounting software.

Cons of GoCardless

- Accounting features need to be supplemented with other software.

- Some businesses might require a more diverse set of payment options than direct debit.

- Users may face limitations when trying to customize payment schedules and amounts.

Pricing

The GoCardless pricing plans depend on each transaction you make through it;

- Standard package: 0.5% + $0.05 for each transaction, capped at $5.00. For International payments, 1.50% + $0.05.

- Advanced package, 0.75% + $0.05 for each transaction, capped at $6.25. For International payments, 1.75% + $0.05.

- Pro package, 0.90% + $0.05 for each transaction, capped at $7.00. For International payments, 1.90% + $0.05.

Customer Support Options

Here are some customer support options available at GoCardless:

- Help desk

- Knowledge base

Average Customer Rating

GoCardless has an average rating of 4.7 out of 5 on software directories like GetApp.

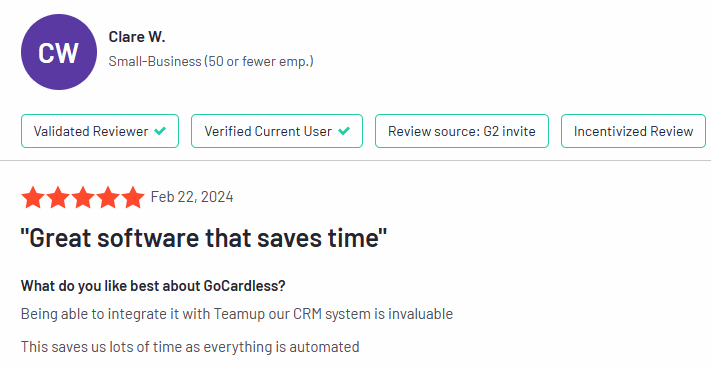

Testimonials

Final Verdict

GoCardless is a pivotal solution for SaaS businesses, supporting subscription payments and enabling global expansion through its international payments feature. With Success+ optimizing payment success rates, it offers a reliable financial backbone, ensuring smooth and efficient transaction processes for businesses aiming for growth without borders.

8- Zuora

Zuora is your go-to when thinking about subscription models and monetization strategies for SaaS. Imagine having a platform that’s not just about billing but also about nurturing your subscribers’ journey.

Zuora offers a suite of services that’s pretty much a dream for any SaaS business looking to scale. It helps companies of all sizes and sectors to price, package, and sell their goods on a recurrent basis via relationship management, invoicing, and financing.

Features of Zuora

Here’s a list of features Zuora offers.

- Zuora Billing

- Zuora Revenue

- Zephyr

- Zuora Payments

- Zuora CPQ

- Zuora Platform

- Zuora Monetization Suite

Top 3 Features of Zuora

Zuora offers multiple features; however, these are the features that Zuora is most known for:

1- Zuora Billing

Zuora billing automates complex billing processes for various pricing models, making it easier for businesses to adapt and scale their subscription offerings.

2- Zuora Revenue

Zuora maintains revenue recognition compliance with global accounting standards, providing accurate financial reporting and insights.

3- Zuora Payments

Zuora offers secure and flexible payment solutions, supporting 40+ payment methods and gateways to enhance customer transactions, and uses machine learning to reduce failed payments.

Pros of Zuora

- Manage the entire customer subscription lifecycle.

- Offers sophisticated analytics tools to understand subscription data.

- Highly customizable platform.

Cons of Zuora

- The complexity of the system might require a dedicated team or individual to manage.

- The price point and the complex features could be overwhelming for smaller SaaS businesses.

- The user interface could be modernized to improve navigation and usability.

Pricing

The pricing plans for Zuora depend on the features that you opt for. For particular pricing details, one needs to contact Zuora directly, as it does not disclose its pricing details publicly.

Customer Support Options

Average Rating

Zuora has an average rating of 3.9 out of 5 across famous software directories.

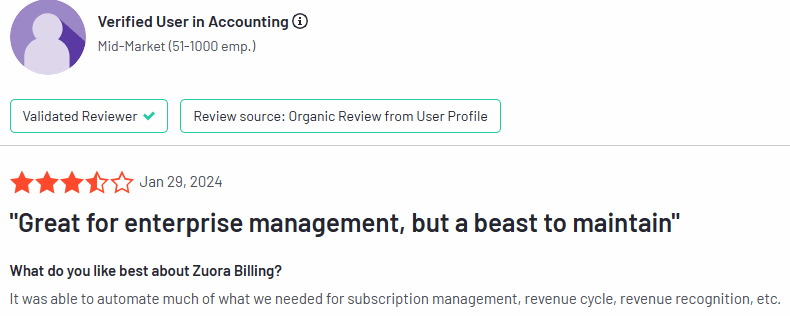

Testimonials

Final Verdict

Zuora offers scalability and compliance, allowing SaaS businesses to focus on innovation and user experience. It is the perfect tool for businesses with a subscription-based model, facilitating growth through user data, analytics, and testing.

9- Recurly

Recurly is all about bringing simplicity and precision to subscription billing and management. It’s designed to cater to businesses looking for an efficient way to handle recurring billing, manage subscriptions, and reduce churn.

With features like automated billing, flexible subscription plans, and detailed analytics, Recurly aims to streamline the financial aspects of running a subscription service, making it easier for companies to focus on growth and customer satisfaction.

Features of Recurly

Here’s a list of features offered by Recurly:

- Plans, Pricing, and Promotions

- Subscriber Management

- Payments Orchestration

- Recurring Billing

- Churn Management

- Revenue Recognition

- Reporting and Analytics

- App Management

Top 3 Features of Recurly

Among all of its features, these top features are what make Recurly stand out:

1- Recurring Billing

When it comes to choosing the best accounting software for SaaS, Recurly can’t be missed. Recurly’s recurring billing feature allows you to automate, tackle, and scale with ease. It helps automate recurring billing and invoicing with precise tax calculations. It simplifies complexities if entering a new market through flexibility and customization. It also allows you to scale up or down with ease without any development effort.

2- Subscriber Management

Recurly helps manage subscribers at scale. With integrated subscription and communications solutions that eliminate complexity and spur growth, you can manage subscribers and subscriptions with ease and get a comprehensive perspective of them.

3- Churn Management

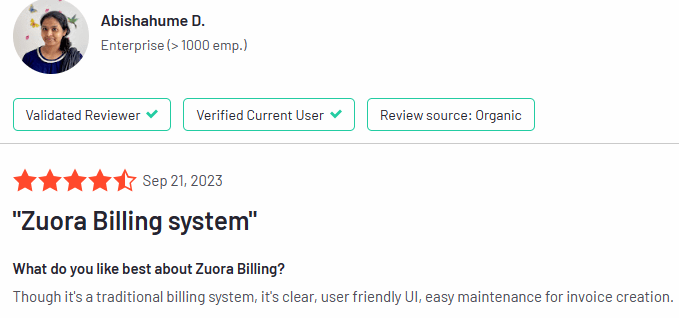

With churn management, you can minimize failed payments and recover failed payments before you lose a customer. It helps you offer upsell opportunities at relevant times, provide add-ons, and retain customers for longer periods of time.

Pros of Recurly

- Provides a variety of billing models

- Strong analytics suite to track subscription health and reduce churn.

- Offers a flexible and developer-friendly API for customization.

Cons of Recurly

- It is not a stand-alone accounting solution.

- Customization and advanced setups may require developer resources.

- Some users find the reporting tools to be less flexible than needed for in-depth analysis.

Pricing

Recurly has three different pricing plans for users, Starter, Professional, and Elite.

- New users can opt for the Starter plan for free for 12 months. It costs $249 for old customers.

- To get Professional and Elite plans, you’ll need to talk to their experts.

Customer Support Options

Following are the available customer support options at Recurly:

- 24/7 access to self-service resources

- Direct phone call

- chat

Average Rating

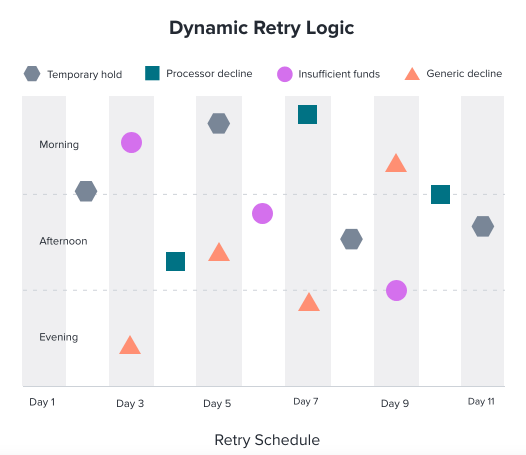

Over popular software directories, like GetApp and G2, Recurly has an average rating of 3.9 out of 5.

Testimonials

Final Verdict

Recurly offers abundant advantages, especially for subscription-based pricing models. Even though it is not a stand-alone accounting software, with its revenue recognition and churn management features, it is worth the investment to grow your SaaS business.

10- Zoho Books

Zoho Books is a comprehensive accounting solution that fits small and medium-sized businesses well. It offers a wide range of features, from invoicing and expense tracking to financial reporting and tax compliance.

Features of Zoho Books

Following are the features that put Zoho Books in our list of best accounting software for SaaS;

- Invoicing

- Quotes

- Customer Portal

- Expenses

- Bills

- Banking

- Projects

- Inventory

- Sales Order

- Purchase Orders

- Tax

- Online Payments

- Reporting

- Automation

- Documents

- Vendor Portal

- Mobile

Top 3 Features of Zoho Books

The top 3 features that Zoho Books is known for are as follows:

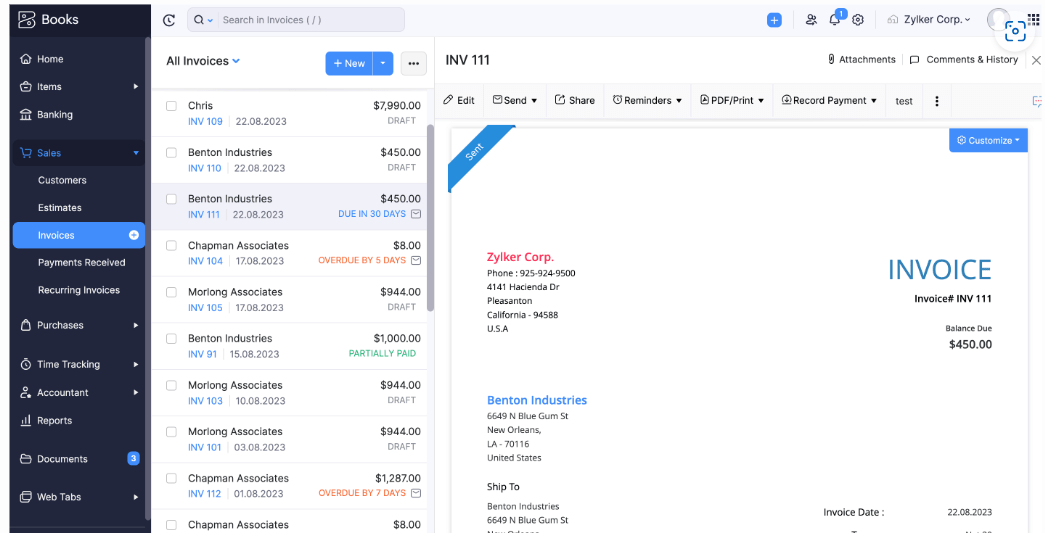

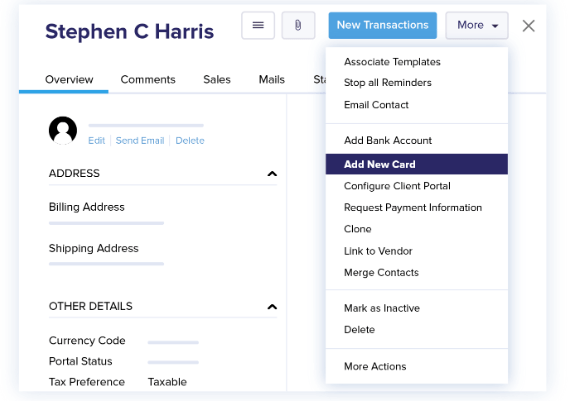

1- Invoicing

Through Zoho Books, you can send customizable invoices and get payments from multiple online payment options. You can receive payments in multiple currencies and automate follow-ups in case of payment delays. You can also create better relationships with your long-term clients by creating recurring invoices and setting up credit cards for them to pay securely.

2- Online Payments

Zoho Books is integrated with multiple online payment gateways. It helps you create a hassle-free online payment experience for your customers. You can also auto-charge clients for recurring transactions, eliminating any worries about collecting payments so you can focus on your products.

3- Reporting

Using Zoho Books reporting tools, you can schedule reports and get real-time data needed to optimize your SaaS business and make business decisions. With its dashboard capabilities giving you access to data at all times, you can make up-to-date business plans for the steady growth of your services.

Pros of Zoho Books

- Affordable pricing with a comprehensive set of features.

- Integration with the Zoho suite of products increases productivity.

- Good automation features for recurring invoices and billing.

Cons of Zoho Books

- It may not be suitable for larger businesses that need complex financial management.

- The user interface could be overwhelming for beginners.

- Some limitations in third-party app integrations compared to competitors.

Pricing

Zoho Books has five different pricing plans, which are given below:

- Free package is only for businesses with less than $50K in revenue per annum.

- Standard package costs $12 if you pay monthly and $10 if you are billed annually.

- Professional package costs $24 if you pay monthly and $20 if you are billed annually.

- Premium package costs $36 if you pay monthly and $30 if you are billed annually.

- Elite package costs $129 if you pay monthly and $100 if you are billed annually.

- Ultimate package costs $249 if you pay monthly and $200 if you are billed annually.

Customer Support Options

Following are the available customer support options at the Zoho Books:

- Call support

- Knowledge academy

- Email support

- FAQs

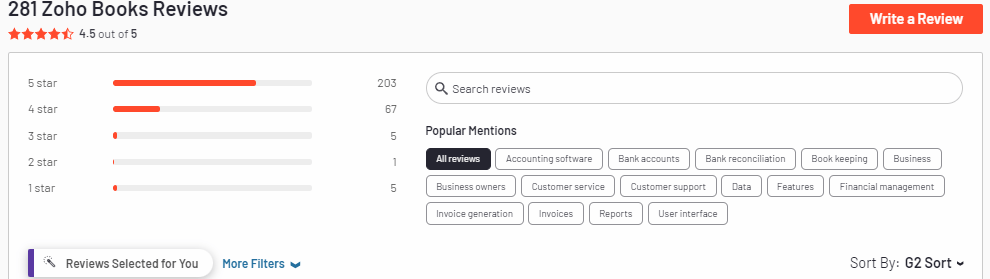

Average Customer Rating

The average rating given to Zoho Books by its users and customers is 4.5 out of 5. This is gathered from software directories like GetApp and G2.

Testimonials

Final Verdict

Zoho Books is an ideal accounting software for SaaS businesses seeking a comprehensive yet intuitive accounting solution. Its automation, online payments, and reporting tools streamline financial management, enabling SaaS companies to focus on growth and customer satisfaction efficiently.

Table of Comparison

| Feature / Software | FreshBooks | Recurly | Sage Intacct | NetSuite | QuickBooks Online | Xero | Maxio | GoCardless | Zuora | Zoho Books |

| Subscription Billing | ✓ | ✓ | ✗ | ✗ | ✗ | ✗ | ✓ | ✓ | ✓ | ✗ |

| Revenue Recognition | ✗ | ✓ | ✓ | ✓ | ✗ | ✗ | ✓ | ✗ | ✓ | ✗ |

| Subscription Management | ✗ | ✓ | ✗ | ✗ | ✗ | ✗ | ✓ | ✗ | ✓ | ✗ |

| Multi-Currency Billing | ✓ | ✗ | ✓ | ✓ | ✓ | ✓ | ✗ | ✗ | ✗ | ✓ |

| Automated Financial Reporting | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✗ | ✗ | ✓ | ✓ |

| Expense Management | ✓ | ✗ | ✓ | ✓ | ✓ | ✓ | ✗ | ✗ | ✗ | ✓ |

| Cloud-Based Access | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| CRM Integration | ✗ | ✗ | ✓ | ✓ | ✗ | ✗ | ✗ | ✗ | ✓ | ✗ |

| Sales Tax Automation | ✓ | ✗ | ✓ | ✓ | ✓ | ✓ | ✗ | ✗ | ✗ | ✓ |

| International Payments | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ | ✓ | ✗ | ✗ |

| Time Tracking | ✓ | ✗ | ✗ | ✗ | ✓ | ✓ | ✗ | ✗ | ✗ | ✓ |

| Customizable Invoices | ✓ | ✗ | ✗ | ✗ | ✓ | ✓ | ✗ | ✗ | ✗ | ✓ |

Best of the Best – Top 3 Accounting Software for SaaS

1- FreshBooks

FreshBooks offers an intuitive, user-friendly solution that simplifies invoicing, expense tracking, and time management, making it a valuable asset for service-based SaaS models.

2- Recurly

Recurly is highlighted for its precision and simplicity in subscription billing and management, offering features like; automated billing, flexible subscription plans, and detailed analytics to streamline the financial aspects of running a subscription service.

3- Xero

Xero provides small to medium-sized businesses with real-time financial reporting, multi-currency support, and smooth integration with over 800 apps. Xero provides SaaS businesses with the tools they need to manage their finances efficiently.

Conclusion

Selecting the best accounting software for SaaS companies can seem overwhelming, but with the right information, one can optimize financial processes and foster company growth. Such software often includes ERP systems capable of managing revenue recognition or integrating third-party add-ons for additional features.

However, Stratigia is always available to lend its expertise and drive results for companies seeking top-tier SEO and content services. Contact us to see how we can expand your digital strategy.

Frequently Asked Questions

1. What makes accounting software essential for SaaS businesses?

SaaS businesses face unique financial challenges like managing recurring revenue, subscription billing, and customer churn. Specialized accounting software helps address these complexities efficiently.

2. How does SaaS accounting software save time?

By automating tasks like invoicing, expense management, and revenue recognition it minimizes manual data entry, freeing up time for strategic business decisions.

3. Is cloud-based accounting software secure for SaaS companies?

Yes, reputable providers use encryption, multi-factor authentication, and continuous updates to keep your financial data safe. Just ensure strong passwords and secure devices on your end.

4. How does it handle revenue recognition for SaaS?

It automates revenue recognition processes in line with standards like ASC 606 and IFRS 15, ensuring compliance and accuracy in your financial reports.

5. Can SaaS accounting software integrate with other business tools?

Yes, it typically integrates with CRMs, payment systems, and banking apps, allowing seamless data flow and reducing redundant work.

6. What should I consider for subscription and billing management?

Look for features that handle recurring billing, subscription tiers, and revenue forecasting to optimize cash flow and customer retention.

7. Does it help with tax compliance for SaaS businesses?

Absolutely! It automates tax calculations, stays current with tax laws, and generates reports that simplify tax filing and compliance.